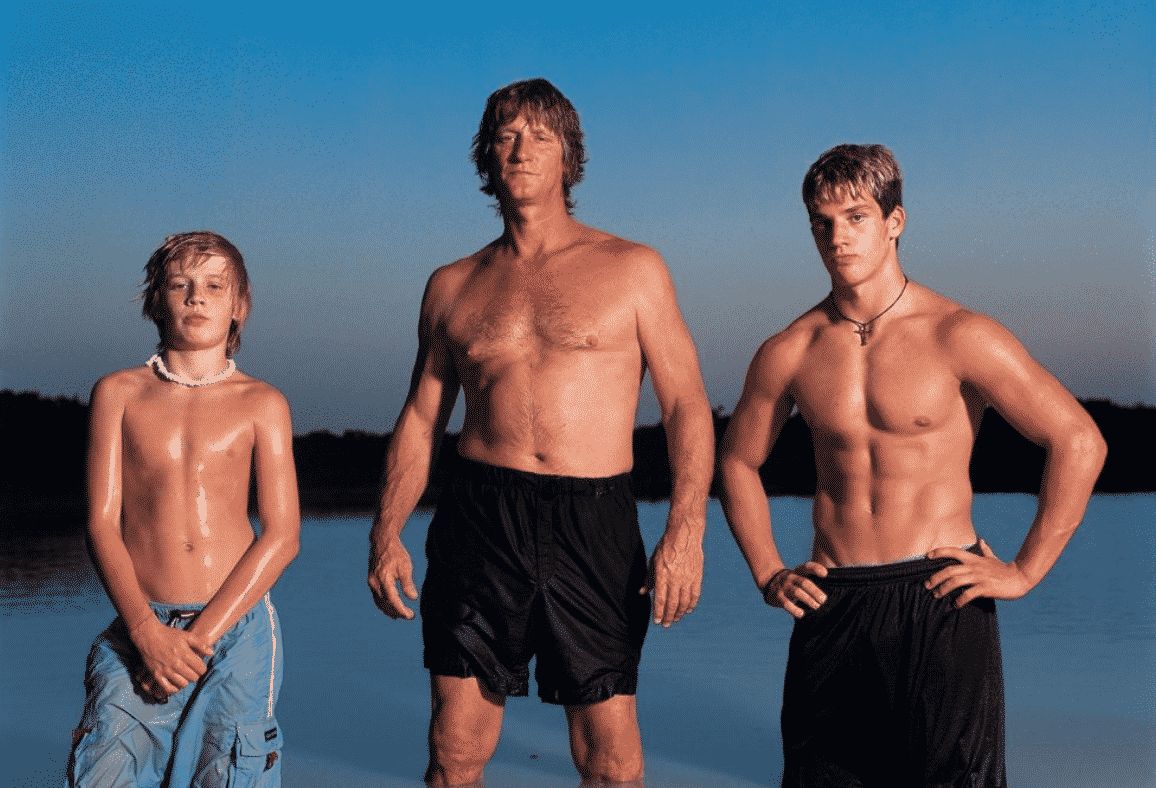

Kevin Von Erich Net Worth 2023: Unveiled

Determining an individual's net worth involves calculating the total value of their assets, minus their liabilities. Assets encompass possessions like real estate, investments, and personal property. Liabilities represent debts, such as loans and outstanding balances. This calculation provides a snapshot of an individual's financial standing.

Publicly available information about a person's net worth is often limited. Lack of transparency or specific disclosures may make pinpointing an exact figure challenging. This is true for many individuals, especially if they have not sought to publicize their financial situation. Consequently, a precise determination of Kevin von Erich's net worth is not readily available through easily accessible sources. While estimations can be made based on available information, these are typically just thatestimatesand cannot be verified definitively.

Further research into Kevin von Erich's financial situation may involve exploring details of his career, investments, and reported transactions, as well as details of financial transactions publicly available. Information regarding business ventures and financial holdings could potentially provide clues about his financial condition. However, detailed financial records are usually not the public domain. This is a common scenario for individuals whose financial activities have not been extensively reported.

What Is Kevin Von Erich's Net Worth?

Determining Kevin Von Erich's net worth requires careful consideration of various financial factors. An accurate figure is often difficult to establish due to a lack of readily available data.

- Assets

- Liabilities

- Income sources

- Investment history

- Business ventures

- Public records

- Financial disclosures

- Estimation methods

Assessing Kevin Von Erich's net worth necessitates examining his assets, including property and investments. Liabilities, such as outstanding debts, must be subtracted. Income sources, like professional earnings and investments, directly influence the financial picture. A review of his investment history and business ventures offers additional insights. Public records, though potentially limited, can provide clues. Analyzing financial disclosures, if available, can offer clearer understanding. Estimation methods, often employed when precise data is lacking, can be used to approximate the net worth. Ultimately, a comprehensive understanding of Kevin Von Erich's financial situation hinges on the careful evaluation of these various aspects. For instance, if his income was primarily from wrestling and related ventures, the earnings from these ventures would be key to assessing his financial position.

1. Assets

Assets play a crucial role in determining net worth. Their value contributes directly to the overall financial picture. Understanding the nature and extent of an individual's assets is essential for evaluating their financial standing.

- Real Estate Holdings

Property ownership, including homes, land, and commercial buildings, represents a significant component of assets. The market value of these properties is a key factor in calculating net worth. Variations in property types and location directly influence their value and overall contribution.

- Investment Portfolios

Stocks, bonds, mutual funds, and other investment vehicles contribute to an individual's overall asset base. The fluctuating nature of the market necessitates ongoing assessment of investment portfolio value to understand its influence on net worth.

- Personal Possessions

Items like vehicles, jewelry, artwork, and other personal belongings can have monetary value and, therefore, impact net worth estimations. The evaluation of these possessions often involves appraisals to ascertain their current market value.

- Business Interests

Ownership stakes in businesses or enterprises, whether small or large, contribute significantly to the total asset base. Valuing these interests involves complex considerations, including the business's financial performance and market position.

Assessing the value of these various assets is crucial for determining an accurate net worth. The combined total of these assets, after accounting for liabilities, provides a comprehensive picture of an individual's financial position. Determining a precise value for each asset category, and the resultant net worth, can be complex and necessitates meticulous analysis of market conditions and associated legal factors.

2. Liabilities

Liabilities represent financial obligations owed by an individual. Understanding these obligations is essential in calculating net worth, as they directly reduce the overall value. Subtracting liabilities from assets yields a precise calculation of net worth. The absence or limited reporting of liabilities can significantly impact the accuracy of any net worth estimation.

- Debt Obligations

Loans, mortgages, credit card balances, and other outstanding debts represent significant liabilities. The amount and terms of these debts directly affect the calculation of net worth. Unpaid taxes and legal judgments are also relevant and must be considered.

- Outstanding Financial Commitments

Unfulfilled contractual agreements, such as guarantees or performance bonds, constitute liabilities. The estimated value of these commitments must be factored into the calculation. Potential future liabilities, while often more speculative, could be relevant if they are substantial or reasonably foreseeable.

- Financial Guarantees

Guarantees made on behalf of others or entities represent liabilities that must be considered. The obligations undertaken through guarantees could represent a substantial liability, potentially impacting the final estimation of net worth. The conditions and potential triggering events of these obligations are relevant factors.

- Uncertain Future Obligations

While speculative, potential future obligations, such as pending lawsuits or contingent liabilities, should be considered in a comprehensive evaluation. The degree of certainty or likelihood of these future obligations must be weighed carefully to determine their impact on present net worth. Significant legal challenges or settlements could substantially alter the calculation.

A comprehensive assessment of liabilities is crucial for a thorough evaluation of net worth. The presence and impact of various liabilities contribute to a complete understanding of an individual's financial standing. While precise estimations of liabilities might be challenging in the absence of comprehensive financial disclosures, their accurate representation, as much as possible, remains essential in establishing a true understanding of the individual's financial position. Ultimately, the inclusion of liabilities, and their appropriate valuation, directly shapes the accuracy of any estimation for net worth.

3. Income Sources

Income sources are a critical component in assessing net worth. Understanding the nature and volume of income streams directly impacts any calculation of Kevin Von Erich's financial standing. The variety and stability of these sources provide insights into the overall financial picture, illustrating the interplay between income generation and accumulated wealth.

- Professional Earnings

Professional wrestling, a key aspect of Kevin Von Erich's career, served as a primary income source. Earnings from wrestling appearances, including matches, promotions, and merchandise sales, were influential. Fluctuations in his career trajectory and the demand for his services would have directly affected his income levels. Details regarding specific wrestling contracts and compensation packages, if available, would greatly aid in estimating the overall income generated from this source.

- Investment Income

Potential investment activities, such as real estate holdings or stock investments, could have generated additional income. The return on these investments would have influenced the overall financial picture. Examining the history of such investments, if available, helps understand their contribution to Kevin Von Erich's net worth.

- Business Ventures

Any businesses or enterprises Kevin Von Erich may have owned or been involved in would have contributed to his income. The profitability and performance of these ventures directly affected the overall income generated. Information regarding these ventures and their financial performance, if accessible, offers a crucial perspective.

- Other Income Sources

Other income sources, such as endorsements, sponsorships, or royalties, if present, should be considered. The value and consistency of these streams would have contributed to the total income and, thus, influenced his overall financial condition. Public records or statements related to such engagements would be vital in establishing the contributions.

In summary, income sources, including professional wrestling earnings, investments, business ventures, and other streams, collectively influence the assessment of Kevin Von Erich's net worth. Analyzing the details of each income source provides a more complete picture of his financial standing. However, without specific information, pinpointing an exact figure remains challenging.

4. Investment History

Investment history is a crucial component in determining net worth. The types and performance of investments directly influence the overall financial position of an individual. Understanding the investments made by Kevin Von Erich, including their timing, strategy, and returns, is essential to any comprehensive estimation of his net worth. Successful investments amplify the overall value of assets, while unsuccessful ventures can diminish it.

Analyzing investment history reveals patterns and trends that shed light on financial decisions. For example, a consistent investment strategy in high-growth sectors might indicate a calculated risk tolerance and potential for substantial returns. Conversely, a history of speculative investments or a reliance on short-term gains could potentially reflect a higher risk tolerance and may or may not correlate with a higher net worth. The level of diversification in investments also provides insights. A portfolio heavily concentrated in a single asset class or industry might expose the investor to greater risk than a diversified portfolio. Returns and market conditions associated with investments influence their valuation and contribute to the total net worth. A careful review of past investment decisions can offer valuable context for evaluating present financial standing.

A detailed examination of investment history, when available, provides a clearer picture of the factors that contributed to the growth or decline of an individual's financial position. This information is fundamental in understanding the correlation between financial decisions and an individual's overall wealth accumulation. While specific details of Kevin Von Erich's investments are not publicly available, the importance of examining this aspect for any individual is clear. Understanding the connection between investment history and net worth offers invaluable insights into the complexities of financial decision-making and their impact on overall financial success.

5. Business Ventures

Business ventures undertaken by an individual directly impact their net worth. The success or failure of these ventures significantly influences the overall financial position. Understanding the nature and performance of these endeavors is crucial for a comprehensive assessment of Kevin Von Erich's financial status. Revenue generated, expenses incurred, and the resulting profits or losses directly contribute to the calculation of net worth. The value of any ownership stakes in businesses is also a key factor.

- Profitability and Revenue Streams

The profitability of business ventures is a critical determinant in evaluating net worth. Revenue generation, stemming from various sources within a venture, forms a significant part of this assessment. Examining the extent of revenue and its stability provides insights into the sustainability and value of the business. Profitability determines the eventual contribution to the overall net worth.

- Asset Valuation Within Ventures

Assets held within a business venture can directly impact an individual's net worth. For instance, the value of real estate, equipment, or intellectual property owned or held by the venture is relevant. Appraisals and market valuations play a critical role in understanding the financial contribution of such assets to the business's and, consequently, to the individual's net worth.

- Debt and Liabilities of Ventures

Debts associated with a venture directly reduce an individual's net worth. Loans, outstanding invoices, or other financial obligations linked to the business venture must be considered and subtracted from the overall asset value to determine the net worth impact. The financial obligations and their potential impact on the individual's other assets and income must be thoroughly assessed.

- Ownership Structure and Equity Value

The structure of business ownership significantly impacts net worth. The value of equity held in a venture, either directly or indirectly, represents a portion of an individual's total net worth. Understanding ownership percentages and associated rights helps in calculating the contribution to the overall financial status. The worth of the equity is influenced by the financial performance and overall health of the business.

In conclusion, the impact of business ventures on an individual's net worth is multi-faceted and significant. Revenue, assets, liabilities, and equity must all be analyzed to gain a complete picture of their financial standing. The success or failure of these ventures plays a crucial role in determining the final figure, influencing Kevin Von Erich's overall financial position. Assessing these ventures requires a careful review of related financial records and market conditions to provide a thorough evaluation of their impact.

6. Public Records

Public records, when available and relevant, can potentially provide clues about an individual's financial situation, including Kevin Von Erich's. These records, however, are not always exhaustive and may not fully reflect the totality of a person's net worth. Their value lies in the insights they offer into specific aspects of financial life, rather than providing a definitive figure for total net worth.

- Property Records

Property records, including deeds, mortgages, and tax assessments, might reveal real estate holdings. The presence and value of property can be a piece of the puzzle. However, these records often only reflect the legal ownership of property, not the full market value or the value associated with improvements. Moreover, such records usually do not encompass all assets, but only the ones officially recognized in the legal framework.

- Court Records

Court records, including lawsuits, judgments, and bankruptcies, might offer insights into financial disputes, debt obligations, or previous legal actions involving finances. Judgments and liens placed against an individual could indicate financial difficulties, potentially affecting their overall financial picture. However, court records do not necessarily provide a complete picture of all financial commitments, and interpretations of such records should be approached carefully.

- Tax Records (if available)

Tax records, if publicly accessible, can potentially reveal income levels and deductions. These records provide information about tax liabilities and payments but typically do not encompass the full scope of financial activity, nor are they comprehensive about all assets and liabilities. Interpretation of tax records alone is insufficient for determining net worth accurately. Additional data sources are essential.

- Business Registration Information

Records of business registrations, if available, may reveal business ventures and ownership structures. This information can be relevant, but typically only highlights registered business activities, not all investments, or assets held privately or outside the registered companies. It is important to avoid overgeneralizing from such data.

In conclusion, public records can offer fragments of information about financial activities but are not a comprehensive source for determining net worth. To form a thorough understanding of an individual's financial position, these records must be seen in conjunction with other potential sources of information, such as those related to income, investments, and business dealings. Without further information, conclusions drawn from such records are limited and should be viewed with caution.

7. Financial Disclosures

Financial disclosures, when available, are crucial in determining net worth. They provide a direct insight into an individual's financial situation, encompassing assets, liabilities, and income streams. A comprehensive disclosure often details ownership of properties, investments, and business ventures, thereby offering a more complete picture than potentially limited public records. Lack of disclosure, however, makes accurate net worth estimation significantly more challenging.

The importance of financial disclosures in calculating net worth is undeniable. Consider a scenario where an individual has substantial holdings in privately owned companies or complex investment portfolios. Public records might not reveal these holdings. However, a formal financial disclosure, perhaps within a legal context, could detail these assets and their associated values. This direct disclosure offers a far more accurate representation of net worth than reliance on limited publicly available data. In contrast, a lack of disclosure, especially regarding substantial assets or liabilities, can make determining a precise net worth nearly impossible, potentially leading to inaccurate estimates.

In summary, financial disclosures, when present, offer a transparent pathway to understanding an individual's net worth. However, their absence necessitates reliance on alternative, often less precise, methods. The availability and comprehensiveness of financial disclosures directly affect the accuracy and reliability of any estimate of net worth. This understanding is vital for making informed assessments in financial contexts, whether personal or professional.

8. Estimation Methods

Estimating an individual's net worth, such as Kevin Von Erich's, often necessitates alternative approaches when direct financial disclosures are unavailable. Estimation methods leverage available data, including public records, career information, and market analysis, to approximate a figure. These methods offer a framework for evaluating financial standing even when complete details are absent.

- Analysis of Public Records and Information

This method involves scrutinizing publicly accessible information, such as property records, tax filings, and legal documents. Examining property records, for instance, can provide clues about assets like real estate holdings. However, public records frequently offer limited details, and insights derived are typically incomplete representations of the full financial picture. Incomplete financial records limit the precision of any derived estimate.

- Professional Financial Analysis

Experts in financial analysis often utilize specialized tools and methodologies to assess net worth based on available information. Their expertise encompasses market trends, industry standards, and financial modeling techniques to form estimations. However, these estimations rely on available data and assumptions, and the resulting estimates can vary. The estimation of Kevin Von Erich's net worth through this lens is complicated by the paucity of public information.

- Reverse Engineering from Income Sources

Assessing professional earnings, particularly from careers like wrestling, can help infer potential asset accumulation. Calculating potential returns on investment based on career income provides a framework for estimating the potential net worth. However, accurate estimations require precise income figures, reliable historical investment data, and assumptions about investment strategies. The lack of detailed information about Kevin Von Erich's investment history makes such calculations complicated.

- Market Comparison and Benchmarking

Comparing an individual's career profile and accomplishments to similar individuals in the same or comparable fields can offer insights into potential earnings and assets. Using industry benchmarks for income, assets, and spending habits can help establish a relative value range for the individual being assessed. Accurate market comparisons require adequate data from comparable individuals in similar circumstances. Without detailed career statistics and the absence of comparable figures in the wrestling industry, accurate benchmarking can be difficult.

Ultimately, estimation methods provide approximations rather than precise figures. The absence of comprehensive financial disclosures necessitates relying on available data. The accuracy of estimated net worth depends heavily on the completeness and reliability of the available information. In cases like Kevin Von Erich's, where detailed information remains limited, estimations must be considered within the context of the existing data and the inherent limitations of each employed method. These estimations should be understood as educated guesses, not definitive financial statements.

Frequently Asked Questions about Kevin Von Erich's Net Worth

Determining Kevin Von Erich's precise net worth presents challenges due to limited publicly available financial information. These FAQs address common inquiries regarding his financial status.

Question 1: What is the precise net worth of Kevin Von Erich?

A precise figure for Kevin Von Erich's net worth is not publicly available. Lack of comprehensive financial disclosures and limited public records hinder a definitive calculation. Estimates vary significantly depending on the methodology and data used.

Question 2: Why is accurate information about Kevin Von Erich's net worth difficult to obtain?

Limited public financial records and disclosures characterize the challenge of estimating net worth. Private financial matters and a lack of detailed reporting contribute to this difficulty. Information pertaining to investment strategies, business ventures, and personal assets may not be accessible to the public.

Question 3: What factors are considered when estimating an individual's net worth?

Estimation methods consider various aspects, including assets (e.g., real estate, investments, personal possessions), liabilities (e.g., debts, loans), and income sources. Historical income, investment records, and business activities are also significant factors in estimations.

Question 4: How do public records contribute to understanding net worth estimation?

Public records, though limited, provide clues. Property records, court documents, and business registrations offer fragments of information. However, these records often represent only a partial view of an individual's overall financial situation.

Question 5: Can estimations of net worth be accurate without complete financial disclosures?

Estimation methods, while not producing exact figures, can provide a general range. These estimations, however, rely on available data and assumptions. Their accuracy depends significantly on the completeness and reliability of the data source. Absence of full financial disclosure inherently introduces uncertainty.

Question 6: What limitations are inherent in estimating net worth?

Estimating an individual's net worth faces limitations due to private financial matters and a lack of exhaustive public data. Estimating methods, by nature, are approximations, not definitive statements of financial position. The estimations inherently contain an element of uncertainty.

In conclusion, while a precise net worth figure for Kevin Von Erich remains elusive, understanding the methods used for estimation, and the inherent limitations, is essential. The estimation process requires considering various factors, but a definitive calculation is not feasible without complete and transparent financial disclosure.

The next section delves into the complexities of evaluating financial well-being, highlighting the significant role of both public and private information.

Tips for Researching Net Worth

Determining an individual's net worth involves a multifaceted process. Access to comprehensive financial data is crucial for accurate assessments, but such data is frequently incomplete or unavailable to the public. The following tips provide guidance for those seeking to research an individual's financial standing.

Tip 1: Focus on Public Records. Initial research should center on readily available public records. These may include property records, tax filings (if accessible), court documents, and business registrations. Careful scrutiny of these documents can offer initial insights into assets, liabilities, and potential income sources. However, remember that public records often provide only a partial picture.

Tip 2: Identify Potential Income Sources. Researching an individual's career and professional history can reveal potential income streams. Analysis of professional activities, such as wrestling careers, endorsements, or business ventures, helps identify sources that may have contributed to wealth accumulation. Investigating the nature and duration of these endeavors provides valuable context. Consider the potential for fluctuating income based on performance or market conditions.

Tip 3: Evaluate Assets and Liabilities. Scrutinize potential assets, such as real estate holdings, investment portfolios, and other tangible assets. Identifying any known debts, loans, or liabilities is equally crucial. Comparing asset values to known liabilities helps understand the net worth picture. Analyze the potential contribution of assets and the impact of liabilities on the overall financial standing. Consider potential undisclosed assets or liabilities.

Tip 4: Understand Investment Strategies. Analyzing past investment behaviors, if available, can reveal an individual's risk tolerance and investment strategies. The types of investments undertaken, the timing of investments, and associated returns offer insight into the individual's financial history. Evaluate potential diversification and the impact of market fluctuations on investment returns. Consider the potential for undisclosed investments.

Tip 5: Use Estimation Methods Carefully. When comprehensive data is lacking, estimation methods can provide a range. However, these estimates rely on assumptions and may not accurately reflect the individual's true financial position. Expert financial analysis may be required for accurate estimations. Avoid relying solely on estimations derived from limited information.

Tip 6: Consider the Limitations of Public Data. Public records often provide an incomplete view of an individual's financial situation. Private investments, personal assets, and undisclosed liabilities are not typically reflected in these records. Understanding these limitations is crucial for interpreting the available data.

By carefully applying these research techniques, while acknowledging the inherent limitations of incomplete data, individuals can gain a more comprehensive understanding of an individual's financial standing, though complete accuracy remains elusive.

Further research, particularly if focused on specific areas, might involve contacting financial professionals or legal representatives to gain additional insight.

Conclusion Regarding Kevin Von Erich's Net Worth

Determining Kevin Von Erich's net worth presents significant challenges due to the limited availability of publicly accessible financial information. The absence of comprehensive financial disclosures and detailed public records hinders the calculation of a precise figure. Analysis of potential income sources, including professional wrestling earnings and business ventures, along with an assessment of assets, liabilities, and investment history, are necessary components of any estimate, yet such data remains largely incomplete. Consequently, estimations must acknowledge the inherent limitations and should be understood as approximations rather than definitive statements.

The difficulty in pinpointing Kevin Von Erich's net worth underscores the complex interplay between public and private financial matters. The lack of transparency in private financial activities necessitates caution when interpreting publicly available data. The absence of complete financial documentation highlights the limitations of external assessments in evaluating an individual's total financial standing. Furthermore, this complex scenario underscores the importance of complete and accurate financial disclosures for a clear understanding of an individual's financial status. Without such disclosures, the task of evaluating net worth remains inherently complex and ultimately, open to various interpretations and estimations.

Article Recommendations

- Sowndharya

- Antonio Pierce Head Coach Salary

- Guruvayoor Ambalanadayil Near Me

- Second Key Telugu Movie In Tamil

- Cast Of Rumble Fish

- Chris Hanburger Net Worth

- Lovely Runner Ep 12

- Maeve Courtier Lilley

- Bill Whitaker Net Worth

- Carti Dropping Album