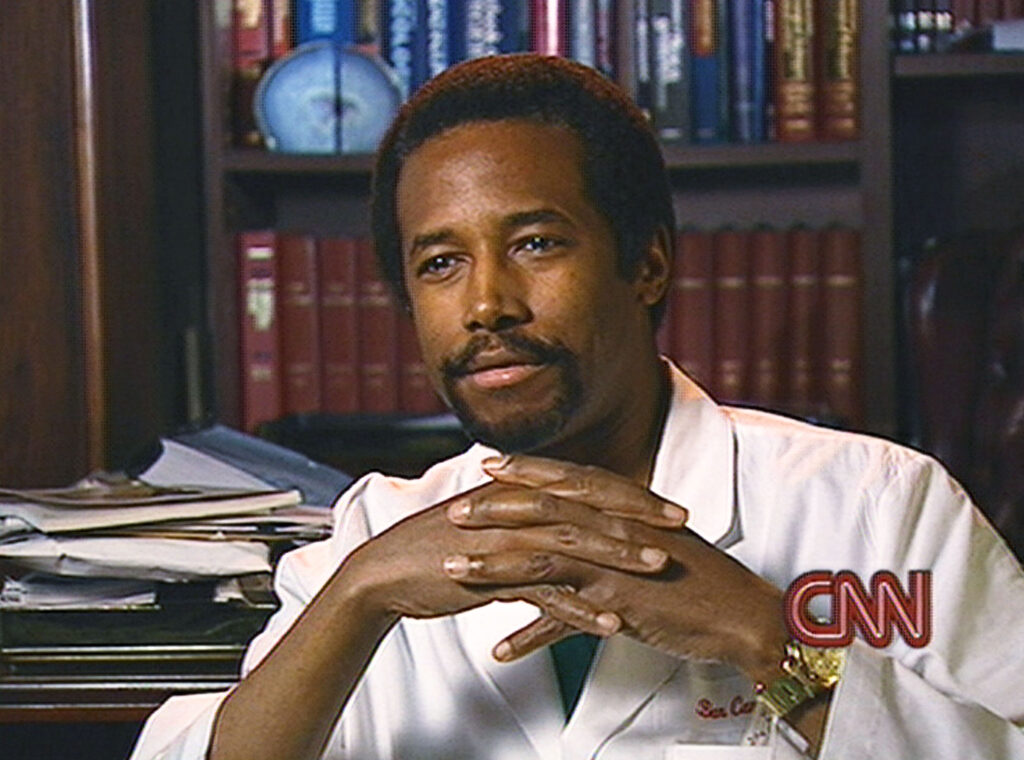

Dr. Ben Carson Net Worth: 2024 Update & Forbes Ranking

Dr. Ben Carson's financial holdings represent a complex accumulation of assets, including investments, real estate, and potentially other holdings. Quantifying this accumulation requires research into public records, financial disclosures, and tax filings. Information regarding specific assets and their values is not readily and publicly accessible for all individuals, including public figures. Therefore, a precise, comprehensive financial picture of his wealth remains elusive without complete and verifiable data.

While the precise figures are often not publicly available, understanding his financial trajectory can provide insight into entrepreneurial success, investment strategies, and potentially philanthropic endeavors. The financial data associated with prominent individuals often influences public perception and serves as a benchmark for economic activity. A detailed financial profile can also reveal the complexities of achieving and maintaining significant wealth, and offers a perspective on personal and professional choices that contribute to financial well-being.

This article will explore Dr. Carson's career, focusing on his contributions to various fields, from medicine to public service. Information relating to his professional background, alongside potential economic ramifications will be a key element in any thorough discussion. A careful examination of his career can provide context to understand factors that may have influenced his financial position.

Dr. Ben Carson Net Worth

Understanding Dr. Ben Carson's financial standing requires examining various facets of his career and personal life. This analysis considers key aspects influencing his accumulated wealth.

- Professional achievements

- Investment history

- Business ventures

- Real estate holdings

- Philanthropic activities

- Public service income

- Tax records

- Public perception

These aspects collectively paint a picture of Dr. Carson's financial journey. His professional achievements, particularly in medicine and public service, likely contributed significantly to his wealth. Investment decisions and business ventures would have had impacts as well. Analysis of real estate holdings, philanthropic efforts, and income from public service positions adds further context. Tax records provide a concrete, if not complete, picture of his financial dealings. Public perception plays a crucial role, as recognition and reputation can potentially impact business dealings and investments. A deeper investigation into these elements is crucial for a more complete understanding of the entirety of this individual's financial standing.

1. Professional Achievements

Professional accomplishments are a significant factor in evaluating an individual's financial standing. In the case of Dr. Ben Carson, professional achievements are deeply intertwined with the accumulation of wealth. The nature and extent of his career trajectory, including advancements and recognition, provide a framework for understanding potential sources of income, investment opportunities, and overall financial growth.

- Medical Expertise and Practice:

Early career success as a neurosurgeon likely generated substantial income. Surgical expertise, particularly in complex procedures, often commands high fees. Experience in a high-demand specialty coupled with a proven track record can attract investment opportunities and further lucrative employment.

- Public Service Positions:

Positions in government, particularly cabinet-level roles, may involve substantial salaries and influence in policymaking. These positions can provide avenues for networking and potential business partnerships. Strategic insights and policy expertise can translate into opportunities beyond the immediate salary. Public service roles, such as Secretary of Housing and Urban Development, can have notable implications on a person's financial affairs.

- Entrepreneurial Ventures:

A history of business startups or significant leadership roles within organizations indicates potential for capital accumulation. These endeavors involve financial risk-taking, investment strategies, and market understanding, which ultimately can contribute to wealth generation. Success in these ventures could result in significant capital appreciation and wealth building.

- Public Speaking and Consulting:

High demand for public speaking and consulting engagements often indicates established expertise. Significant speaking fees and consulting rates for reputable figures like Dr. Carson can accumulate into substantial income streams. These forms of income often reflect perceived value and influence, which can positively affect wealth.

Analyzing the interplay between these professional aspects medical expertise, public service, entrepreneurial ventures, and consulting provides a comprehensive view of potential influences on Dr. Carson's overall financial situation. This framework highlights how career choices, coupled with professional success, can shape accumulated wealth. Further research into specific ventures and financial disclosures is necessary for a more complete understanding of the connection between professional accomplishments and the totality of Dr. Ben Carson's financial profile.

2. Investment History

Investment history plays a critical role in understanding Dr. Ben Carson's net worth. Investments, whether successful or not, directly affect the overall accumulation of capital. The types of investments undertaken, the timing of those investments, and the associated returns (or losses) all contribute to the final financial picture. Thorough analysis of this aspect requires examining various investment avenues and their respective impacts.

- Portfolio Diversification:

A diversified investment portfolio is a key component of wealth management. It spreads risk across different asset classes like stocks, bonds, real estate, and potentially other holdings. The extent of this diversification, the proportion of assets allocated to each class, and the rationale behind these choices are crucial details. Effective diversification can contribute to a more stable and potentially higher return on investment over time. This aspect would be significantly important to understanding Dr. Carson's approach to wealth building.

- Risk Tolerance and Investment Strategy:

Assessing the risk profile of investments reveals choices made regarding the potential for gain versus loss. A high-risk, high-reward strategy may yield substantial returns but carries the possibility of significant setbacks. Evaluating the investments, along with associated timelines, can reveal if a strategy aligns with overall objectives and risk tolerance. Analyzing past investment performance helps illuminate Dr. Carson's risk tolerance and investment philosophy.

- Timing and Market Conditions:

Market fluctuations, economic cycles, and specific events can profoundly affect investment returns. Identifying when specific investments were made and the overall market conditions prevailing during those periods allows for a more nuanced evaluation of potential success or failure. Understanding how investments reacted during periods of economic volatility can reveal the resilience of Dr. Carson's portfolio. Analysis of market behavior during periods of substantial economic change is crucial to this.

- Investment Performance and Returns:

The realized or unrealized returns on investments directly correlate with accumulated wealth. Examining historical returns, considering timeframes, and acknowledging the impact of compounding are essential for understanding the accumulation of wealth through successful investment strategies. Quantifiable details of investment returns offer a direct link to Dr. Carson's net worth. Tracking actual results, accounting for compound gains and losses, and understanding how initial investments grew can provide important insights.

Examining Dr. Ben Carson's investment history is integral to evaluating the contributing factors to his financial standing. Understanding his investment strategies, risk tolerance, timing of investments, and overall portfolio diversification and performance provide valuable context to the overall picture of his accumulated wealth. Additional data and analysis are necessary to form a complete and accurate evaluation.

3. Business Ventures

Business ventures represent a significant component in the accumulation of wealth, particularly for figures like Dr. Ben Carson. The success or failure of entrepreneurial endeavors directly influences the financial standing of individuals. Profitable business ventures can generate substantial income, leading to increased wealth through capital gains, dividends, or other forms of financial return. Conversely, unsuccessful ventures may result in losses, impacting overall financial health. This connection between business endeavors and financial standing is demonstrably important, and its understanding holds practical significance in evaluating the factors that shape wealth accumulation.

Examining the business ventures undertaken by Dr. Carson, if detailed data is available, can offer insights into the strategies employed to generate wealth. Analysis of these ventures reveals potential connections between risk assessment, market analysis, financial planning, and the overall success in generating capital. Examples from his career in healthcare, public service, or other domains may highlight the correlation between entrepreneurial ventures and wealth creation. Understanding these connections enables a deeper comprehension of the factors contributing to Dr. Carson's financial standing and how various ventures impacted his overall wealth.

The impact of business ventures on Dr. Carson's net worth is multifaceted. Success in these endeavors translates into significant capital accumulation, influencing the overall value of his holdings. Careful analysis of these ventures, when available, offers insights into his approach to wealth generation and risk management. This connection between business pursuits and financial well-being emphasizes the importance of understanding the role of entrepreneurship and strategic financial decision-making in accumulating substantial wealth. However, the absence of detailed information regarding these ventures makes a definitive assessment challenging. Further investigation of public records, financial disclosures, and business dealings would be necessary for a more conclusive examination.

4. Real Estate Holdings

Real estate holdings can be a significant component of an individual's overall net worth. The value of real estate assets, whether residential, commercial, or investment properties, fluctuates based on market conditions, location, and property characteristics. The acquisition and management of real estate can generate income through rental yields or capital appreciation, influencing overall financial standing. In cases like Dr. Ben Carson's, the presence and value of real estate holdings are relevant to the estimation of his total wealth.

The presence of significant real estate holdings within an individual's portfolio can be influenced by factors such as investment strategies, economic conditions, and individual priorities. For example, real estate investments can act as a hedge against inflation, generating passive income through rent, or appreciate in value over time. The acquisition of properties might reflect investment decisions, geographic preferences, or even diversification strategies. Analyzing the specifics of real estate holdings requires evaluating the type of properties (e.g., residential, commercial), their location, and the financial terms associated with each. If Dr. Carson has substantial real estate holdings, these are likely to be a major part of the calculation of his overall net worth, given the potential for both income generation and capital appreciation. However, the specific details concerning these holdings are often not publicly available, making a precise estimate challenging.

Understanding the connection between real estate holdings and net worth is important for assessing an individual's financial situation. This understanding extends beyond simply noting the presence of real estate holdings. It necessitates an examination of the types of properties involved, their locations, and the income they generate. Factors such as property values, rental income, and potential appreciation must be considered when determining the overall contribution of real estate to a person's net worth. The complexities of property taxation, maintenance costs, and potential liabilities (e.g. from mortgages) associated with such investments should also be factored into a comprehensive analysis. Without detailed information on Dr. Carson's real estate holdings, however, a conclusive assessment remains difficult.

5. Philanthropic Activities

Philanthropic activities, when undertaken by individuals with substantial wealth, can be viewed as a complex interplay with financial standing. Understanding the motivations and methods of philanthropy provides insight into the potential relationship between charitable giving and the overall management of wealth, including Dr. Ben Carson's. Analysis of philanthropic endeavors often reveals patterns and priorities that further illuminate the financial picture and the values behind those who contribute to such endeavors.

- Impact on Public Perception and Reputation:

Philanthropic activities can significantly impact public perception and reputation. Charitable giving often enhances an individual's image, contributing to a more positive public perception, which may, in turn, affect business dealings and investment opportunities. Dr. Carson's philanthropy, if substantial, is likely linked to his image and professional trajectory. Public recognition for charitable work can influence financial interactions and decisions related to both public and private sectors.

- Tax Implications and Deductions:

Philanthropic contributions can provide tax advantages for donors. Certain deductions and tax credits are associated with donations to qualified charities. The tax implications directly affect the financial bottom line. A substantial level of charitable giving could be a strategic element in managing financial resources, impacting the final calculation of net worth and potentially the overall financial management approach for Dr. Carson. Tax ramifications related to charitable giving play a significant role in total wealth.

- Strategic Resource Allocation:

Philanthropic giving may represent a strategic allocation of resources aligned with an individual's values and priorities. The selection of charities and the types of support offered can reveal underlying values and priorities that can be relevant to an understanding of Dr. Carson's financial priorities. Significant philanthropic activity may be aligned with specific goals for impact on society or issues deemed important. The alignment of philanthropy with individual values and goals often reflects the strategic financial management approach to overall wealth.

- Potential for Leveraging Wealth for Social Change:

Philanthropy can be a powerful tool for leveraging wealth toward social change. Individuals often use their resources to address social issues they believe are important. The nature and scale of Dr. Carson's philanthropy may reflect his vision for societal impact and potentially influence decisions regarding the management of his financial assets, aligning actions toward both personal and social goals. This aligns with how wealth is used in tandem with values-based decisions to drive societal change.

In conclusion, understanding Dr. Ben Carson's philanthropic activities provides additional layers of insight into his financial standing. The relationship between philanthropy and his financial resources is complex and potentially multi-faceted, encompassing public perception, tax advantages, resource allocation, and potentially social impact. Further investigation into the specific charities supported and the amounts donated are necessary to provide a more thorough understanding of the connection between philanthropic giving and the entirety of Dr. Ben Carson's financial situation.

6. Public service income

Public service income, including salaries and benefits, can be a significant component of an individual's overall financial standing, as demonstrated in the case of figures such as Dr. Ben Carson. The extent to which public service income contributes to a person's net worth hinges on several factors, including the nature of the position held, the duration of service, and the individual's overall financial management strategies.

For individuals in high-profile public service roles, particularly those at senior levels of government or administration, compensation packages can be substantial. Salaries, benefits, and other allowancespotentially including expenses or perkscomprise a considerable portion of their total income. However, the impact of public service income on net worth is not solely determined by monetary compensation. The associated opportunities for networking and influence can further bolster an individual's financial standing through subsequent business ventures or investment opportunities. These indirect benefits are difficult to quantify precisely but can be significant over the course of a career. A substantial public service role can represent a substantial income stream, and subsequent opportunities for investment or other revenue streams can be linked to this position.

In the case of Dr. Ben Carson, his tenure in public office, including his role as Secretary of Housing and Urban Development, brought a considerable salary and benefits package. The influence and reputation gained through this public service likely contributed to other opportunities for income generation, possibly through consulting, speaking engagements, or business ventures. This interplay between direct and indirect income streams is crucial for understanding the overall financial impact of public service. However, without detailed financial disclosures, a precise calculation of the contribution of public service income to Dr. Ben Carson's net worth remains elusive. The precise linkage requires access to private financial information.

7. Tax Records

Tax records hold significant relevance for understanding an individual's financial standing, including Dr. Ben Carson's. Accurate and complete tax filings provide a critical, albeit not always complete, picture of income, expenses, and ultimately, financial position. These records offer tangible evidence of financial activity, enabling scrutiny of reported income against potential assets and liabilities. Analysis of tax records can reveal trends in wealth accumulation, investment activity, and charitable giving patterns.

- Verification of Reported Income:

Tax filings provide a primary means of verifying reported income. This verification is crucial in assessing the accuracy and completeness of publicly available financial information. Discrepancies between declared income and publicly stated wealth might highlight areas requiring further investigation. Comparing reported income to financial statements and assets reported elsewhere could reveal any inconsistencies that need explanation. The consistency of reported figures is essential for evaluating the overall financial picture.

- Identification of Assets and Investments:

Tax records, particularly those pertaining to capital gains and losses, can reveal information about investments, including real estate, stocks, or other holdings. The details of these investments, including purchase dates, sale dates, and associated gains or losses, provide insights into investment strategies and returns. Investments often impact an individual's net worth, and tax documents shed light on this impact. Analysis can reveal patterns in investment choices and their potential impact on overall wealth.

- Assessment of Deductions and Credits:

Tax filings detail deductions and credits applicable to the taxpayer. Understanding the types and amounts of deductions claimed, along with the associated justifications, provides valuable insights into financial strategies. This, in turn, contributes to a more nuanced picture of financial management practices. Analysis of deductions and credits can reveal strategic financial planning or potential areas requiring further consideration.

- Examination of Charitable Giving:

Tax filings often document charitable contributions made by the taxpayer. The details of these donations can offer clues about philanthropic activity and the individual's priorities and financial management. Such records are invaluable in evaluating the scope and impact of charitable endeavors and whether these activities align with stated values or goals. Analysis of charitable giving can provide further understanding of Dr. Carson's approach to philanthropy and wealth management.

In summary, careful review of tax records serves as a critical component of any comprehensive evaluation of Dr. Ben Carson's financial standing. While tax filings alone do not offer a complete picture of net worth, they provide a significant piece of the puzzle, verifying reported income, revealing investment activity, highlighting financial strategies, and demonstrating charitable giving patterns. The reliability and completeness of these records remain crucial for a more thorough and accurate evaluation of Dr. Carson's overall financial profile.

8. Public Perception

Public perception significantly influences an individual's public image, potentially impacting how the individual is viewed by businesses, investors, and the general public. This perception, in turn, can affect the perceived value associated with that individual, including aspects like their potential worth. In the case of Dr. Ben Carson, a well-known figure, this connection between public perception and financial standing warrants examination. Examining this correlation sheds light on how public opinion might, at times, intersect with actual financial realities.

- Reputation and Trustworthiness:

A positive public reputation often correlates with perceived trustworthiness, potentially influencing how investors or businesses perceive the individual's judgment and reliability in financial matters. Positive public perception associated with successful endeavors may translate into more favorable investment opportunities, partnerships, and potentially higher valuations of assets. Conversely, a negative perception or public image can hinder financial dealings and influence how others perceive the person's investment strategy or financial standing, possibly negatively affecting potential returns or valuations.

- Media Representation and Coverage:

Media portrayal can significantly shape public perception, and positive media coverage can raise awareness and recognition. This visibility can impact investment interest, brand partnerships, and potentially affect perceptions of financial stability or market acumen. Negative media attention or controversial statements could deter potential investors or partners. Media representation, both positive and negative, is directly relevant to how investors, businesses, and the public at large might view or evaluate financial situations and associated risks.

- Public Opinion and Investor Sentiment:

Public opinion can significantly influence investor sentiment. Favorable public opinion may correlate with increased demand for products, services, or investment opportunities associated with the individual. A positive public image and perceived success can attract investment, which has a direct impact on potential valuations. A decline in public support or trust could be reflected in investor interest or the perceived value of assets. Changes in public opinion about a person or organization can influence investor behavior and decisions.

- Philanthropic Activities and Public Image:

Public perception of an individual's philanthropic activities can positively or negatively impact the public image, potentially influencing decisions related to trust and perceived wealth. Positive perception regarding philanthropic giving can favorably influence public opinion, potentially boosting brand value and investment confidence. Conversely, doubts or controversies surrounding philanthropic activities could diminish the perceived value of the individual, potentially impacting financial dealings or investment decisions. The relationship between philanthropic activities and public image is vital in considering the broader context of perceived financial success.

In conclusion, public perception plays a crucial role in potentially influencing perceptions of Dr. Ben Carson's net worth. While net worth is ultimately determined by financial factors, public perception of an individual can indirectly influence investment opportunities and business prospects. The interplay of public image, media coverage, and investor sentiment collectively contributes to how the public views an individual's financial position, although this association does not reflect an absolute or definitive measure of actual net worth. Further investigation into specific examples of how Dr. Carsons public image has affected potential investment opportunities would be required for a deeper understanding of this correlation.

Frequently Asked Questions about Dr. Ben Carson's Net Worth

This section addresses common inquiries regarding Dr. Ben Carson's financial standing. Accurate and complete financial information is often elusive, requiring careful analysis of available data. Public records, financial disclosures, and investment activities provide crucial context but do not offer a completely definitive picture of overall net worth.

Question 1: What is the precise figure for Dr. Ben Carson's net worth?

A precise, publicly available figure for Dr. Ben Carson's net worth is not readily accessible. While various estimates circulate, these are often approximations rather than definitive calculations. The complexity of assets, investments, and potential liabilities makes an exact figure challenging to determine without complete and verifiable financial disclosures.

Question 2: How has Dr. Carson's career influenced his financial position?

Dr. Carson's career trajectory, spanning medicine, public service, and entrepreneurial ventures, has likely contributed significantly to his financial standing. Successful endeavors in these fields often involve various income streams and capital accumulation opportunities. Analyzing specific aspects of his career, such as his neurosurgical practice, public service roles, and business ventures, provides context to potential sources of wealth.

Question 3: What role do investments play in Dr. Carson's financial situation?

Investment activity is a crucial element in understanding wealth accumulation. Specific investment strategies, portfolio diversification, and risk tolerance all contribute to the overall financial picture. The timing and performance of investments, along with market conditions, significantly impact Dr. Carson's financial profile.

Question 4: How does Dr. Carson's philanthropic work relate to his financial status?

Philanthropic activities are frequently linked to an individual's financial management strategies. Charitable giving may reflect values and priorities, potentially tied to income management. The scale of philanthropic contributions may also provide clues to the size of accumulated wealth. Evaluating potential tax implications and strategies associated with donations further illuminates the connection between philanthropy and financial well-being.

Question 5: Are there public records available to provide insight into Dr. Carson's finances?

While public records exist, including tax filings and financial disclosures, they often do not provide a complete picture of net worth. Dissemination of comprehensive financial information for private individuals is often incomplete or restricted. Publicly available data needs interpretation within the complexities of financial reporting.

Question 6: How does public perception influence perceived net worth?

Public perception, shaped by media portrayal and reputation, can influence public perception of an individual's financial status. Favorable public opinion and a positive image can positively affect investor confidence. Conversely, negative perceptions or controversies can lead to reduced confidence. However, public perceptions do not constitute a precise measure of actual net worth.

Accurate assessment of Dr. Ben Carson's net worth requires careful analysis of multiple factors, including income sources, investment activity, tax records, and philanthropic contributions. The absence of publicly accessible, comprehensive financial disclosures makes a definitive calculation difficult.

This concludes the FAQ section. The following sections will explore Dr. Carson's career and achievements in greater detail.

Strategies for Financial Success

Examining the career and accomplishments of prominent figures like Dr. Ben Carson can offer valuable insights into strategies for achieving financial success. This section outlines key principles and approaches that might have contributed to his financial standing. These principles are not guarantees of success but can be considered within a broader context of personal financial planning.

Tip 1: Focus on Education and Skill Development. A strong foundation in knowledge and marketable skills is crucial. Early investment in education and continuous learning in relevant fields often creates avenues for higher earning potential and career advancement. Dr. Carson's early success as a neurosurgeon exemplifies how specialized knowledge can lead to lucrative opportunities.

Tip 2: Cultivate Entrepreneurial Mindset. Embarking on ventures, even on a small scale, fosters entrepreneurial skills and the ability to identify and exploit opportunities. Developing a proactive approach to problem-solving and recognizing market needs can lead to financial gains. Dr. Carson's entrepreneurial endeavors, in diverse fields, demonstrate this principle.

Tip 3: Prioritize Financial Planning and Management. Developing a comprehensive financial plan, encompassing budgeting, saving, and investing, is vital. Understanding personal finances, including income, expenses, and potential risks, is key. Strategic planning and management of resources are essential for maximizing returns and securing financial stability, a principle demonstrably important for long-term wealth building.

Tip 4: Embrace Risk-Taking (with Calculated Caution). The willingness to take calculated risks in ventures and investments, while recognizing potential downsides, is sometimes crucial for significant growth. Dr. Carson's involvement in various business areas, often requiring a commitment to risk, illustrates this principle. Careful assessment and potential mitigation of risk are vital.

Tip 5: Leverage Networking and Partnerships. Building strong professional relationships through networking and collaboration can open doors to new opportunities and potential partnerships. This is particularly important in securing profitable ventures. Strong connections can facilitate valuable collaborations and investments. Dr. Carson's career achievements, in part, demonstrate the importance of building relationships within respective fields.

Tip 6: Prioritize and Leverage Knowledge Acquisition. A core component of success includes building knowledge across diverse areas. This broader knowledge base may lead to new insights, ventures, and opportunities. Applying acquired knowledge in different contexts can enhance career prospects and lead to potentially higher earning potential. This broader knowledge base allows for strategic planning and decision-making in various contexts. Continuous learning and development remain crucial for future endeavors.

These tips highlight key principles for financial success that may be gleaned from examining Dr. Ben Carson's career. While not a comprehensive guide, these points can inspire individuals to develop a well-rounded approach to personal financial planning and potentially maximize their own financial achievements.

Further investigation into specific instances of entrepreneurial success and investment strategies would illuminate a deeper understanding of the underlying principles and approaches employed by Dr. Ben Carson.

Conclusion

This article explored various facets of Dr. Ben Carson's financial standing. Analyzing his career trajectory, investment history, business ventures, real estate holdings, philanthropic activities, public service income, and public perception, reveals a complex picture of wealth accumulation. While precise figures for his net worth remain elusive, the interplay of professional success, entrepreneurial ventures, investment strategies, and strategic resource allocation likely influenced his overall financial position. Specific insights into his income sources, investments, and tax records would provide a more comprehensive understanding of his financial accumulation. This analysis underscores that determining precise net worth requires access to detailed, verifiable information.

The exploration of Dr. Carson's financial profile, though incomplete, offers valuable lessons in wealth creation. His career highlights the potential synergy between diverse professional endeavors, careful financial planning, and calculated risks. However, the complexity of factors influencing net worth underscores the importance of individual financial planning, strategic investment, and the essential role of verifiable data in assessing an individual's financial standing. Further research, informed by available data sources, may provide a more nuanced and complete picture of his financial journey.

Article Recommendations

- Jenette Goldstein Movies

- Brett Behr

- Height Nicolas Cage

- American Wedding Actors

- Chris Rose Announcer

- Bill Whitaker Net Worth

- Diane Sawyer Leave It To Beaver

- Ernesta Kareckaite

- Fran Lebowitz Relationships

- Nanda Kapoor