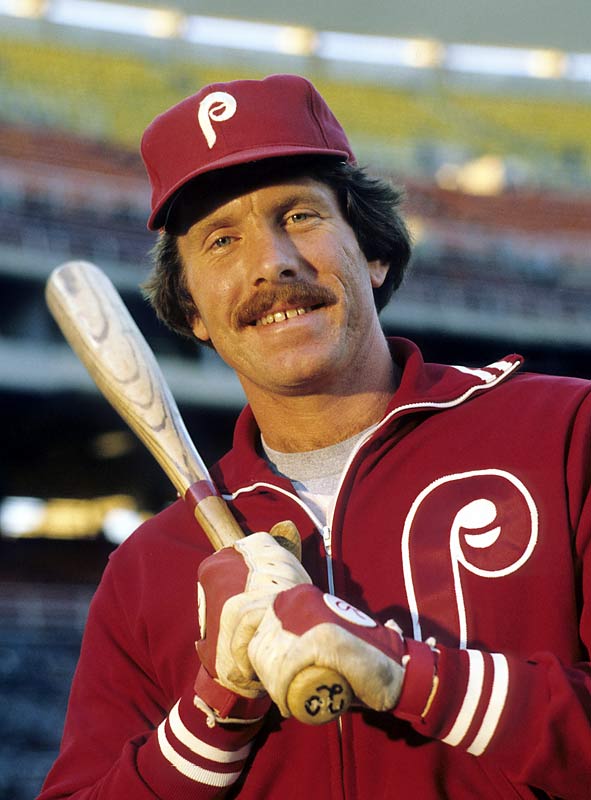

Mike Schmidt Net Worth 2023: Updated Details

Schmidt's financial standing, a reflection of accumulated assets minus liabilities, provides insight into the overall economic value of his holdings. This figure can fluctuate based on market conditions and investments, representing a snapshot of his current wealth. Factors like income from employment, investments, and potentially other sources contribute to this overall metric. Understanding this figure can be relevant in various contexts, including analyses of wealth accumulation, business valuation, and personal finance strategies.

Schmidt's financial standing, like that of any individual, is a complex issue. It may offer a glimpse into potential opportunities or influences in professional circles or public perception, but it should not be misconstrued as a measure of success or worthiness. The value itself does not determine character or intrinsic merit. Furthermore, context is crucial; his wealth's significance and implications vary depending on the specifics of his career, personal circumstances, and the overall economic climate in which it is situated.

The following sections will explore Schmidt's career trajectory, focusing on his professional accomplishments and financial contributions. This investigation will also consider the broader economic and social factors that influence his financial situation. Furthermore, analysis of Schmidt's financial history will be integrated into these considerations.

Mike Schmidt Net Worth

Assessing Mike Schmidt's net worth involves examining various financial factors. This figure reflects accumulated wealth and provides a snapshot of his financial standing. Understanding these key aspects is essential to evaluating his overall economic position.

- Assets

- Investments

- Income

- Expenses

- Liabilities

- Market Fluctuations

- Career Impact

Mike Schmidt's net worth is a complex calculation encompassing various components. Assets, like property and investments, are crucial. Income streams from employment, investments, and other sources contribute significantly. Expenses, a vital part of the equation, influence the remaining wealth. Liabilities, such as debts, reduce the net worth. Market fluctuations impact investment values, changing the net worth figure. Finally, a successful career often translates to higher earnings and, subsequently, greater wealth. These factors intertwine to create the overall financial picture of Mike Schmidt.

1. Assets

Assets, tangible or intangible, represent ownership interests with monetary value. In the context of Mike Schmidt's net worth, assets are crucial components. They are the foundation of his wealth. The value of these assets influences the overall net worth calculation, demonstrating a direct correlation. For example, if Schmidt possesses significant real estate holdings, the market value of those properties directly impacts his net worth. Similarly, valuable investments like stocks or bonds contribute to his overall financial standing. The greater the value and number of Schmidt's assets, the higher his net worth tends to be. Conversely, a decrease in asset value diminishes his net worth. This direct cause-and-effect relationship is fundamental to understanding how assets shape financial standing.

The type and nature of assets also play a critical role. Liquid assets, readily convertible to cash, are generally more impactful on a net worth calculation than illiquid assets. Illiquid assets, like real estate, may hold significant value but aren't as easily translated into immediate cash. The specific types of assets, their market value, and their liquidity all contribute to a comprehensive evaluation of Schmidt's net worth. Careful consideration of these variables is necessary for a thorough analysis.

In conclusion, assets are a vital component of Mike Schmidt's net worth. Their value, type, and liquidity are crucial determinants. Understanding the connection between assets and net worth is essential for comprehending the factors influencing his overall financial position. The relationship is direct, demonstrating how asset values directly impact the total net worth. This principle applies broadly to assessing any individual's financial standing and highlights the importance of asset management in wealth accumulation.

2. Investments

Investments play a significant role in determining Mike Schmidt's net worth. The nature and performance of these investments directly influence the overall financial standing. Successful investments lead to increased wealth, while poor investment choices can diminish it. The value of investments, including stocks, bonds, real estate, or other assets, is a substantial factor in the calculation of net worth. Fluctuations in market values directly translate to changes in net worth, highlighting the interconnectedness of investment decisions and financial well-being.

The impact of investments is multifaceted. Returns from profitable investments contribute to a higher net worth. Conversely, losses from poor investment choices reduce the overall net worth. Diversification of investments is often a key strategy for mitigating risk. Careful portfolio construction and asset allocation choices can profoundly affect net worth over time. Real-world examples illustrate this; successful venture capital investments or shrewd real estate acquisitions can substantially increase an individual's net worth, while speculative investments failing to meet projections can result in significant losses. The potential for substantial gains or losses directly correlates to the importance of informed investment strategies.

Understanding the connection between investments and net worth is crucial. For individuals and businesses alike, informed investment decisions are vital for achieving financial goals. The principles governing investment performancediversification, risk management, and return potentialdirectly impact net worth. Careful consideration of investment strategies, market conditions, and financial goals is essential. This connection underscores the importance of continuous financial education and the impact of sound financial planning on long-term wealth accumulation. In summary, investments aren't just a component of net worth; they are a dynamic driver that significantly shapes it.

3. Income

Income directly impacts Mike Schmidt's net worth. It serves as a primary source of funds, contributing to the accumulation of assets and the reduction of liabilities. Higher income generally leads to a higher net worth, as more resources become available for investment and savings. Conversely, reduced income may restrict opportunities for wealth accumulation and potentially lead to a decline in net worth. This causal relationship highlights the crucial role income plays in shaping financial standing.

The nature of income is crucial. Consistent and substantial income streams, such as those from stable employment or significant investments, offer greater potential for wealth generation and, consequently, a higher net worth. Income derived from fluctuating sources, such as short-term contracts or investments with unpredictable returns, may exhibit a less predictable effect on net worth. The stability and predictability of income are directly correlated with the reliability and sustainability of wealth accumulation. Real-world examples include entrepreneurs who experience significant wealth growth alongside consistent and high-value revenue, or individuals in more established careers with steady salaries, demonstrating how a stable income can contribute to a secure financial future.

Understanding the connection between income and net worth is vital for financial planning and decision-making. Individuals and businesses alike can use this insight to identify areas for improvement, potentially leading to increased income or more efficient financial management. By recognizing income as a crucial component of net worth, financial strategies can be better aligned with overall financial goals. In conclusion, income directly fuels net worth, and a deep understanding of this fundamental relationship is critical for achieving lasting financial success.

4. Expenses

Expenses directly influence Mike Schmidt's net worth. Expenditures, encompassing all outlays for goods and services, act as a counterpoint to income and investment returns. A higher level of expenses, exceeding income and investment returns, can lead to a decrease in net worth. Conversely, managing expenses effectively, keeping them lower than income and investment returns, fosters wealth accumulation and contributes to a higher net worth. This inverse relationship highlights the vital role of expense control in achieving and maintaining financial stability.

The significance of expenses extends beyond simple subtraction. Wise allocation of resources, whether for essential living expenses, investments, or philanthropic endeavors, is critical. Excessive spending on non-essential items or poorly managed debt can erode net worth. Examples include extravagant lifestyle choices or failure to maintain appropriate insurance policies. These actions can negatively impact wealth building and ultimately result in a lower net worth. Conversely, responsible financial management, including targeted savings, investments, and debt repayment strategies, can maximize the net worth increase over time.

Effective expense management is a cornerstone of sound financial planning. Understanding the link between expenses and net worth is crucial for achieving financial goals. For Mike Schmidt, as for any individual, effective cost management is critical for ensuring sustainable wealth accumulation. The relationship demonstrates a practical, real-world application of financial principles. Identifying areas where expenses can be reduced without compromising essential needs is fundamental to growing net worth. In conclusion, expenses are not merely deductions; they are an active force in shaping Mike Schmidt's net worth and should be meticulously considered as part of any financial strategy.

5. Liabilities

Liabilities represent debts or obligations owed by Mike Schmidt. These obligations are a critical component of his net worth calculation, as they directly reduce the overall value of his assets. Understanding the nature and impact of liabilities is essential for a complete picture of his financial position.

- Types of Liabilities:

Liabilities encompass a wide range of financial commitments. These may include loans, mortgages, credit card debt, outstanding invoices, and other financial obligations. Each type of liability carries specific terms and repayment schedules, impacting the overall financial burden. The diverse nature of liabilities underscores the importance of a comprehensive assessment of all outstanding financial commitments for an accurate reflection of net worth.

- Impact on Net Worth:

Liabilities directly reduce net worth. The outstanding amount of each liability, along with its associated interest and fees, decreases the overall value of assets. High levels of debt can significantly diminish the net worth calculation. Conversely, a decrease in liabilities (e.g., successful debt repayment) enhances net worth. This direct correlation between liabilities and net worth underlines the importance of prudent financial management in maintaining a positive net worth position.

- Management and Mitigation:

Effective management of liabilities is crucial. This involves strategies such as timely repayments, interest rate negotiation, and diversification of debt obligations. The proactive management of liabilities can mitigate their negative impact on overall net worth. Strategies for reducing outstanding liabilities and their impact on net worth often involve prioritizing high-interest debt, utilizing debt consolidation strategies, and exploring financial restructuring options when necessary.

- Impact on Cash Flow:

Liabilities significantly affect cash flow. Regular debt repayments consume a portion of available cash flow. High levels of liabilities can strain cash flow, potentially hindering investment opportunities or other financial objectives. Understanding the impact of liabilities on cash flow is essential for managing financial resources effectively and ensuring the long-term sustainability of financial health.

In summary, liabilities represent financial obligations that directly reduce Mike Schmidt's net worth. The types, levels, and management of these liabilities significantly influence his overall financial position. Effective management of liabilities, emphasizing timely payments and debt reduction strategies, is key for preserving and enhancing his net worth. This crucial facet of his financial situation underscores the importance of responsible financial planning and long-term sustainability.

6. Market Fluctuations

Market fluctuations represent a significant variable influencing Mike Schmidt's net worth. Changes in market conditions, particularly in asset values, directly impact the overall financial standing. The dynamic nature of market forces necessitates a nuanced understanding of their role in shaping Schmidt's wealth. This section explores key facets of these fluctuations and their implications.

- Impact on Asset Values:

Market fluctuations directly affect the value of assets held by Schmidt. Changes in market sentiment, economic conditions, and investor behavior influence the prices of stocks, bonds, real estate, and other investments. A rising market can significantly increase the value of these assets, positively impacting net worth. Conversely, a declining market can decrease asset values, potentially lowering net worth. For instance, a stock market downturn might reduce the value of Schmidt's holdings, impacting his overall financial position.

- Investment Portfolio Volatility:

The composition of investment portfolios is critical. Schmidt's portfolio's resilience to market fluctuations depends on diversification and risk tolerance. A diversified portfolio, including various asset classes, can help mitigate risks associated with market downturns. Conversely, a portfolio heavily concentrated in a single asset class may be more susceptible to negative market impacts. The composition of the portfolio and the prevailing market environment determine the degree of volatility in Schmidt's net worth.

- Influence of Economic Conditions:

Broad economic conditions significantly impact market fluctuations. Periods of economic growth often correlate with rising asset prices, positively affecting net worth. Conversely, recessions or other economic downturns typically lead to reduced asset values and negatively affect net worth. For example, during a period of high inflation, the purchasing power of investments can decrease, leading to a potential reduction in net worth, even if asset prices remain static. Fluctuations in interest rates and inflation rates are particularly relevant factors.

- Time Horizon Considerations:

Market fluctuations must be considered within a specific time frame. Short-term fluctuations can be highly volatile but often stabilize over longer periods. A long-term investment perspective may yield more consistent results, albeit with occasional short-term fluctuations. Holding assets for extended periods can allow for market fluctuations to eventually balance out. An investor with a long-term horizon can potentially endure market downturns without significantly altering their overall investment strategy.

Market fluctuations are an inherent part of the financial landscape. They directly influence the value of assets, the portfolio's volatility, and are intricately linked to broader economic conditions. Understanding these interrelationships is crucial for comprehending the dynamics influencing Schmidt's net worth. A diversified investment portfolio, a long-term perspective, and an understanding of economic cycles are essential for mitigating the impact of market volatility and maintaining a stable financial situation.

7. Career Impact

Career trajectory is a fundamental determinant of net worth. The nature of one's profession, its compensation structure, and the overall performance within that field significantly influence accumulated wealth. A lucrative career path, characterized by high earning potential and consistent income, typically results in greater wealth accumulation. Conversely, a career with limited earning capacity or frequent income instability can hinder wealth building. The direct correlation between career success and financial standing is evident in numerous real-world examples.

Specific career achievements can directly impact net worth. For example, high-level executive positions often come with significant compensation packages, including salaries, bonuses, and stock options. These elements contribute substantially to a high net worth. Similarly, entrepreneurs who successfully launch and scale businesses generate substantial wealth through the growth and value appreciation of their ventures. This demonstrates how career choices and related achievements materially contribute to the overall financial standing. Furthermore, successful athletes or entertainers, due to their high demand and lucrative contracts, can accumulate substantial wealth, again highlighting the strong link between career and financial success.

Understanding the connection between career impact and net worth has practical significance. For individuals, this awareness guides career choices, fostering informed decisions that align with financial goals. It underscores the importance of career planning and financial literacy for individuals seeking to achieve a desired financial future. For businesses, comprehending this connection enhances compensation strategies and performance incentives. Consequently, well-structured compensation models that align with career progression and company performance contribute to higher employee motivation and improved business outcomes. Overall, recognizing the role of career impact in shaping net worth promotes informed decision-making in both personal and professional spheres, enabling individuals and organizations to effectively leverage their efforts towards enhanced financial outcomes.

Frequently Asked Questions about Mike Schmidt's Net Worth

This section addresses common inquiries regarding Mike Schmidt's financial standing. The information presented is based on publicly available data and analysis of relevant factors.

Question 1: What is the primary source of Mike Schmidt's wealth?

The principal source of Schmidt's wealth is generally attributed to his career earnings. This includes compensation from various employment positions, as well as potential investment returns from accumulated capital. Detailed breakdowns of these sources are not readily available in the public domain.

Question 2: How does market fluctuation affect Mike Schmidt's net worth?

Market fluctuations directly impact the value of assets within Schmidt's portfolio. Positive market trends enhance asset values and typically increase net worth, while negative trends can reduce it. The extent of this impact depends on the diversity of his investments and his overall investment strategy.

Question 3: What is the significance of Mike Schmidt's income in determining his net worth?

Income serves as a primary driver of wealth accumulation. Higher and more consistent income often leads to increased savings and investment opportunities, thereby contributing positively to net worth. Conversely, lower or fluctuating income can restrict wealth growth.

Question 4: How do expenses influence Mike Schmidt's net worth?

Expenses act as a counterbalance to income and investment returns. Expenditures on various goods and services, along with debt obligations, influence the net worth calculation. Efficient expense management is essential in maximizing wealth accumulation.

Question 5: What role do liabilities play in determining net worth?

Liabilities, such as outstanding debts, represent financial obligations and directly reduce net worth. The amount and type of liabilities significantly impact the overall financial position. Effective debt management strategies are important in maintaining a healthy net worth.

Question 6: What is the historical context surrounding Mike Schmidt's net worth?

Historical context considers factors such as market conditions, economic trends, and overall economic climate during various periods of Schmidt's life and career. Understanding these factors provides a more comprehensive perspective on the evolution of his financial standing.

In summary, these factors interplay to create the overall picture of Mike Schmidt's financial situation. Accurate calculations of net worth require consideration of all relevant components, including assets, investments, income, expenses, liabilities, market fluctuations, and career impact. More detailed and specific information is not publicly available.

The following sections will delve deeper into the specific aspects of Schmidt's career trajectory and financial contributions.

Tips for Understanding Net Worth

Analyzing net worth involves considering various financial factors. This section offers practical guidance for comprehending and evaluating this crucial financial metric.

Tip 1: Recognize the Dynamic Nature of Net Worth. Net worth is not a static figure; it fluctuates based on market conditions, investment returns, and income. Analyzing historical trends alongside current data provides a more comprehensive understanding.

Tip 2: Differentiate Between Assets and Liabilities. Assets represent ownership interestsproperty, investments, etc.while liabilities are debts. A comprehensive net worth calculation requires separating these two crucial elements.

Tip 3: Assess Investment Performance. The returns on investments significantly impact net worth. Evaluating investment choices and their performance history provides insight into the overall financial strategy.

Tip 4: Consider Income Sources and Stability. Income is a vital factor in wealth accumulation. The stability and diversity of income sourcesemployment, investmentsaffect the consistency of net worth growth.

Tip 5: Evaluate Expense Management Strategies. Expenses are a critical counterpoint to income. A prudent approach to expenses, prioritizing essential needs and managing discretionary spending, is key to sustainable wealth accumulation.

Tip 6: Understand the Role of Market Fluctuations. Market volatility directly impacts asset values. A nuanced perspective on market cycles helps to contextualize the fluctuations in net worth.

Tip 7: Factor in the Impact of Career Trajectory. Professional success and income levels are strong determinants of wealth. A career plan that aligns with financial goals enhances wealth-building potential.

Tip 8: Seek Professional Financial Advice When Needed. Complex financial situations benefit from expert guidance. Consult with qualified professionals for personalized insights and strategies.

By following these tips, individuals can develop a more comprehensive understanding of net worth and its various components. Effective financial management strategies often depend on recognizing these interconnected factors.

The subsequent sections will delve deeper into specific areas, like asset evaluation and investment strategies, to further enhance this understanding.

Conclusion

This analysis explored the multifaceted factors contributing to Mike Schmidt's net worth. Examining assets, investments, income, expenses, and liabilities revealed a complex interplay of financial forces. Market fluctuations, career trajectory, and broader economic conditions all played a role in shaping Schmidt's financial position. The evaluation highlighted the dynamic nature of net worth, underscoring that this figure is not static but rather a reflection of ongoing economic realities and strategic decisions. Furthermore, the exploration emphasized the importance of responsible financial management and the crucial impact of consistent income and prudent expense control in building and maintaining wealth.

Ultimately, understanding Mike Schmidt's net worth involves more than simply a numerical value. It necessitates a comprehensive appraisal of the interconnected elements that influence financial standing. This insight, applicable across various contexts, underscores the significance of understanding the forces that shape personal and professional financial realities. The interplay of individual choices, market dynamics, and economic conditions serves as a crucial framework for comprehending wealth accumulation and management. The evaluation, though focused on a specific individual, provides broader lessons applicable to individuals and businesses alike.

Article Recommendations

- Carti Dropping Album

- Stephanie Beatriz Net Worth

- Blackish Net Worth

- Villain Movie 2017

- Peter Mckinnon Wife

- Chris Hanburger Net Worth

- Rosanne Carter Cash

- Celia Weston Movies And Tv Shows

- Jo Koy Relationship

- Alessandro Nivola Movies