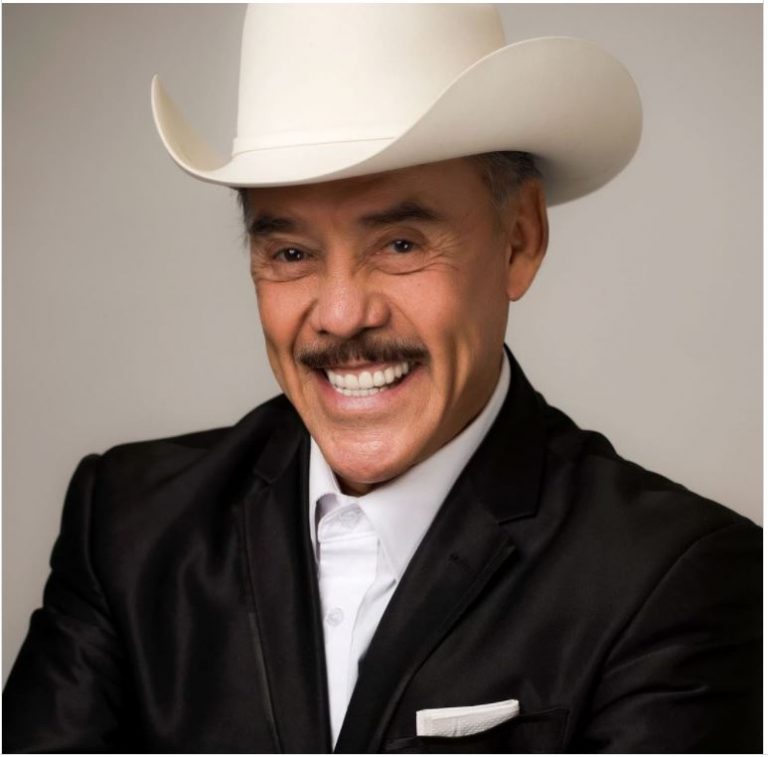

Pedro Rivera Net Worth: A Detailed Look

Determining the net worth of a public figure, such as Pedro Rivera, often involves estimating the aggregate value of assets, including real estate, investments, and other holdings. This valuation is complex and frequently reliant on publicly available information, expert analysis, and potentially, reported income. Directly calculating an exact figure is frequently challenging due to the private nature of some assets and the absence of comprehensive public financial records.

Estimating someone's net worth can be of interest for various reasons. It can offer insight into an individual's financial standing and economic success. Understanding financial trajectories can be informative, showing growth or fluctuations over time. In certain contexts, like business dealings or charitable endeavors, such data might hold significance. Historical and cultural impacts may further emphasize the value of evaluating such figures' financial profiles. However, it's crucial to remember that net worth figures are often estimations, not precise measurements.

The following analysis will delve into publicly available information concerning Pedro Rivera, exploring factors that contribute to such estimations. The discussion will not be limited to Pedro Rivera's net worth but will also include related topics, such as his career, professional achievements, and broader economic context.

How Much Is Pedro Rivera Worth?

Determining the financial worth of individuals, including Pedro Rivera, requires careful consideration of various factors. Publicly available data and expert analysis play crucial roles in formulating these estimates. This exploration highlights key elements in evaluating such valuations.

- Assets

- Income

- Investments

- Liabilities

- Valuation Methods

- Public Records

- Private Information

- Expert Opinion

Evaluating an individual's net worth involves comprehensively assessing their assets, such as real estate holdings or investments. Income streams, both earned and passive, are significant components. Understanding the types of investments, and their current values, is crucial. Liabilities, including debts, must be subtracted from total assets to arrive at a net figure. Determining methodologies for valuation can impact calculated results. Public records, when available, offer valuable insights. However, the privacy of certain holdings may make a precise figure elusive. Expert opinion often assists in estimating values for complex holdings. Combining these elements can provide a better understanding of the estimate of Pedro Rivera's financial position.

1. Assets

Assets form a crucial component in determining an individual's net worth, including that of Pedro Rivera. Quantifying and evaluating these assets is essential for establishing a comprehensive understanding of financial standing. Accurate assessment necessitates careful consideration of various types of assets and their current market values.

- Real Estate

Real estate holdings, such as homes, land, or commercial properties, represent significant assets. Their value is influenced by factors like location, size, condition, and market trends. Appraisals, often performed by real estate professionals, are crucial for determining accurate market values. The value of these holdings can fluctuate based on economic conditions and local market dynamics, thus impacting net worth calculations.

- Investments

Investment portfolios, encompassing stocks, bonds, mutual funds, and other financial instruments, represent another major category of assets. The value of investments is contingent upon market performance. Appreciation or depreciation in the value of these holdings directly impacts overall net worth. Diversification in investment types is often a crucial strategy for mitigating potential risk and enhancing long-term growth.

- Personal Possessions

High-value personal possessions, including luxury cars, artwork, or collectibles, can contribute to an individual's total assets. Appraisals are frequently necessary to establish accurate market values for these items. The inclusion of such assets in net worth calculations depends on the specific context and purpose of the assessment.

- Intellectual Property

If applicable, intellectual property, such as patents or copyrights, can represent substantial assets. The valuation of intellectual property can be complex and often requires expert analysis. The value depends on the potential for future revenue streams or licensing opportunities generated by the intellectual property.

A thorough examination of Pedro Rivera's assets, considering the types, quantities, and current market values, is vital for an accurate calculation of his net worth. This comprehensive analysis must account for potential liabilities and various valuation methodologies to arrive at a reliable estimation. The interplay of these assets, influenced by market fluctuations and economic conditions, ultimately determines the total net worth.

2. Income

Income significantly influences the determination of an individual's net worth. Pedro Rivera's income, encompassing all sources of earnings, plays a crucial role in calculating his overall financial standing. Consistent high income, whether from salary, investments, or other sources, directly contributes to increased net worth over time. Conversely, decreased income or periods of financial hardship can negatively impact net worth. The impact is a direct correlation higher income typically leads to a greater potential for asset accumulation, and vice versa. This relationship holds true for individuals across all income levels, including high-net-worth individuals. Examples include successful entrepreneurs who reinvest profits into their businesses, leading to amplified growth and increased net worth. Similarly, individuals with steady high-income careers, such as athletes or entertainers, often see their net worth increase as a result of consistent earnings.

Understanding the relationship between income and net worth is crucial in financial planning. Careful management of income is essential for building wealth. Saving a portion of income and investing it wisely are strategies that directly impact increasing net worth. Strategies for maximizing income, such as career advancement or diversifying income sources, can positively influence accumulation of assets. Conversely, uncontrolled spending or insufficient saving can hinder the accumulation of wealth. Economic downturns or significant financial commitments can impact income stability and, consequently, affect the overall net worth. This correlation holds practical implications for individuals, families, and businesses. For example, a company's sustained profitability and growth contribute significantly to its net worth, in part due to ongoing income generated through business operations.

In summary, income acts as a primary driver of an individual's net worth, representing a fundamental component for wealth creation. While other factors, such as asset appreciation, play a crucial part, regular income serves as a steady foundation. Understanding this connection between income and net worth is paramount for informed financial decision-making and the pursuit of financial stability. The impact of income extends far beyond personal finances, influencing broader economic conditions and societal trends.

3. Investments

Investments play a significant role in determining an individual's net worth, including that of Pedro Rivera. The nature and performance of these investments directly impact the overall financial standing. This section explores the key aspects of investments in the context of evaluating net worth.

- Types of Investments

Investment strategies encompass a range of financial instruments. Stocks, bonds, real estate, and mutual funds are common examples. The choice of investment type depends on risk tolerance, financial goals, and market conditions. Different investment vehicles carry varying degrees of risk and potential return. An understanding of these variations is critical in forming an investment portfolio tailored to individual needs. Analysis of the historical performance and projected growth of different investment types is crucial to a comprehensive evaluation.

- Investment Returns

Investment returns are a critical aspect. Returns from investments, whether positive or negative, directly impact overall net worth. Growth in investments leads to increased net worth, while losses reduce it. Successful investment strategies aim to maximize returns and minimize potential losses. Fluctuations in the market, economic downturns, and changing interest rates can impact investment returns. Analyzing historical trends and projections for various asset classes is crucial to assess potential returns in different market cycles.

- Investment Diversification

Diversification of investments is a common strategy to mitigate risk. A diversified portfolio spreads investments across various asset classes, reducing the impact of poor performance in any single area. Diversification is generally seen as a prudent strategy for long-term financial growth. Appropriate diversification strategies should reflect risk tolerance and investment goals. A balanced approach often leads to more stable and consistent returns.

- Valuation and Assessment

Accurate valuation of investments is essential for a precise estimate of net worth. Methods for determining the value of different assets vary. Expert analysis, market research, and historical data all play roles in this process. Changes in market conditions and economic factors frequently influence the valuations. Real-time market monitoring and adjusting investment strategies are often components of a robust portfolio management process.

In evaluating Pedro Rivera's net worth, understanding the specifics of his investment portfolio is essential. This includes the types of investments held, their current market values, associated risk, and anticipated returns. The performance of these investments, reflecting economic trends and market cycles, contributes significantly to the overall estimation of his financial standing. The interplay between investment strategy, market conditions, and the specific portfolio composition will significantly affect calculations regarding net worth.

4. Liabilities

Liabilities, representing debts or obligations, are crucial components in determining net worth. Understanding the nature and extent of liabilities is essential for a complete picture of an individual's financial standing. Subtracting liabilities from assets yields the net worth figure, highlighting the importance of considering these financial obligations when assessing overall value. For example, outstanding loans, unpaid taxes, or other financial commitments directly reduce the net worth calculation.

- Types of Liabilities

Liabilities encompass various forms, including loans (mortgages, personal loans, business loans), outstanding credit card balances, and unpaid taxes. Each type carries specific terms and conditions. Accurately assessing and quantifying these liabilities is a fundamental part of the net worth determination process. Understanding the different types helps differentiate between short-term and long-term obligations.

- Impact on Net Worth

Liabilities directly reduce net worth. The larger the amount of liabilities, the lower the net worth calculation. This impact is directly proportional. A person with substantial liabilities may have a lower net worth even if asset holdings are significant. A significant reduction in liabilities, through repayment or settlement, can lead to a corresponding increase in net worth. This can be evident in a case where an individual resolves debt, potentially boosting their overall financial standing.

- Disclosure and Transparency

The accurate portrayal of liabilities is crucial for transparency and fairness in financial assessments. Omitting or misrepresenting liabilities can distort the overall valuation of an individual's worth. Proper disclosure of liabilities often enhances trust and credibility. Understanding the implications of liability transparency is crucial for both personal and professional contexts. A clear and accurate portrayal of liabilities promotes sound financial management and decision-making.

- Impact of Economic Conditions

Economic conditions can influence the amount and impact of liabilities. Periods of economic downturn or high inflation can increase the burden of existing liabilities. This impact can significantly affect the net worth calculation, highlighting the need for proactive financial planning to manage liabilities effectively. Economic factors play a significant role in shaping the liabilities profile of individuals.

In conclusion, liabilities are integral to evaluating net worth, as their value directly subtracts from the calculated net worth. The various types of liabilities, their impact on net worth, and the importance of transparency and accurate disclosure are crucial considerations. Recognizing the influence of economic conditions further underscores the need for a comprehensive and nuanced approach to financial assessment. Ultimately, accurately considering liabilities is vital for a complete and precise determination of net worth.

5. Valuation Methods

Determining the net worth of an individual like Pedro Rivera hinges on the application of appropriate valuation methods. These methods provide a framework for estimating the total value of assets, considering various factors, such as market conditions, and subtracting liabilities. Choosing the right method significantly impacts the final net worth figure. The selection depends critically on the types of assets involved and the context of the valuation.

Several valuation methods exist, each with its own strengths and weaknesses. For tangible assets like real estate, appraisal methods, often performed by qualified appraisers, are commonly used. These methods consider comparable sales, property characteristics, and market trends to arrive at a fair value. Investment portfolios, including stocks and bonds, are typically valued based on market prices. The precise method depends on the specific investments held. Complex assets, such as intellectual property or privately held businesses, might necessitate the involvement of financial experts and specialized valuation methodologies. Often, discounted cash flow analysis or comparable company analysis is employed. These methods assess the future income streams or value the business based on peer company transactions. The choice of the most suitable method, considering the complexity of the assets and the specific objective of the valuation, directly influences the resulting net worth figure. Variations in methodologies can lead to significant discrepancies in the calculated net worth, especially in cases of complex or privately held assets.

The selection of valuation methods is crucial in establishing a reliable and accurate estimate of net worth. The chosen methods must appropriately reflect the characteristics and nature of the assets. A nuanced understanding of these various methods is essential to ensuring that the estimated net worth accurately represents an individual's overall financial position. The process must carefully consider the possible implications of varying methodologies. If, for example, a less sophisticated method is used for complex assets, it can introduce inaccuracies in the final estimate, affecting the reliability of the outcome. In summary, the choice of valuation method is critical to the overall accuracy of the net worth assessment, highlighting the importance of precision and context-awareness in such estimations.

6. Public Records

Public records play a significant role in estimating net worth, including that of Pedro Rivera. These records, often accessible through government agencies, corporate filings, and other publicly available sources, provide a foundation for valuations. While not exhaustive, they offer important data points. Information within these records can corroborate or challenge publicly available estimations. For instance, property records can reveal real estate holdings, including their purchase dates, values, and associated mortgages. Tax records, if accessible, can provide insights into income levels and potentially suggest the size of investment portfolios. Similarly, business filings, where applicable, might show details of enterprises or investments controlled or managed by Pedro Rivera, which can support or refine estimates of his net worth. The reliability of these estimations depends significantly on the completeness and accuracy of the recorded data.

The practical significance of understanding the connection between public records and net worth estimation is multifaceted. For researchers or analysts, access to public records empowers them to develop more accurate and comprehensive evaluations. For example, discrepancies between reported income and asset values might be identified, which, in turn, could trigger further investigation or refine existing estimations. Furthermore, this understanding is relevant for public scrutiny, facilitating a more informed evaluation of an individual's public profile. The availability of publicly accessible records promotes greater accountability and transparency in cases where public figures are involved, aligning with a larger societal expectation for transparency and good governance. However, limitations of public records should always be acknowledged. Data might be incomplete, outdated, or even intentionally misleading, impacting the accuracy of any estimation. Also, the privacy implications inherent in the use of public information should be considered; balance must be struck between access and privacy.

In summary, public records provide crucial data points for understanding net worth. These records offer essential information, but their limitations must be considered. A comprehensive valuation always needs to extend beyond public records, encompassing independent analysis and potentially private information. The availability and accuracy of public records are critical for informed scrutiny and analysis of public figures' financial profiles. Ultimately, a multifaceted approach, incorporating public records alongside other relevant information, offers a more robust estimation of net worth. This highlights the interplay between public record accessibility and the nuanced process of financial evaluation.

7. Private Information

Estimating the net worth of individuals like Pedro Rivera necessitates considering both publicly accessible data and information that remains private. The presence of private information significantly impacts the accuracy and comprehensiveness of net worth estimations. Understanding how this private information affects such valuations is crucial for a thorough evaluation.

- Hidden Assets and Investments

Private holdings, such as privately held companies, high-value art collections, or investments in complex financial instruments, frequently aren't reflected in public records. These private assets can significantly influence net worth but remain largely unknown, potentially distorting estimations based solely on publicly available data. For instance, an individual might possess substantial investments in private equity funds that are not part of public disclosures, dramatically altering the net worth calculation. This illustrates how private holdings contribute to a more nuanced picture of financial standing.

- Complex Financial Structures

Private individuals often utilize intricate financial structures, such as trusts, partnerships, or offshore accounts. These structures can conceal ownership or control, complicating the estimation of net worth. This intricacy renders estimates challenging because valuations might not accurately reflect the true financial position due to opacity in ownership. For example, a significant portion of an individual's wealth could be held within a complex trust structure, making it nearly impossible to ascertain the true amount without access to the trust's inner workings.

- Confidentiality Agreements and Legal Restrictions

Confidentiality agreements related to business dealings, investments, or legal settlements can prevent public disclosure of financial details. These agreements restrict access to crucial data points needed to accurately determine net worth. For instance, confidential settlements regarding business disputes or mergers could involve substantial financial implications, but those details would likely remain undisclosed. This inherent privacy protection can significantly influence accurate net worth assessment.

- Estimating the Unknown

The very nature of private information implies inherent uncertainty in its evaluation. Estimating the value of private assets often relies on expert opinions or educated guesses, given the lack of transparent data. This introduces an element of uncertainty in any net worth estimation, making it more complex to gauge the true financial position of someone like Pedro Rivera, particularly when relying solely on available public records.

In conclusion, the presence of private information significantly affects the accuracy and comprehensiveness of net worth estimations. While public records provide a foundation, understanding the role of undisclosed assets, complex financial structures, confidentiality agreements, and inherent uncertainties is essential for a more robust and complete understanding. The complexities of private information make a precise estimation challenging, highlighting the need for a thorough and multifaceted approach to ascertain the full extent of an individual's financial position.

8. Expert Opinion

Determining the net worth of individuals, such as Pedro Rivera, often involves consulting expert opinions. Experts in finance, accounting, and valuation provide crucial insights into the complexities of assessing assets and liabilities. Their expertise transcends readily available public data, offering a deeper understanding of the true financial picture. This is particularly crucial when private assets or intricate financial structures are involved.

Expert opinions provide valuable context for various asset types. For instance, a real estate appraiser can provide a precise valuation of properties based on comparable sales, market conditions, and property characteristics. Similarly, investment advisors can offer insights into the market value of complex holdings, such as private equity investments or venture capital portfolios. Financial analysts can assess the potential income streams from intellectual property or other intangible assets. The nuanced knowledge and experience of these experts are essential to account for market fluctuations, tax implications, and specific economic conditions pertinent to the individual's financial circumstances.

Real-world examples highlight the importance of expert opinions. A valuation of a high-value art collection would require an expert art appraiser, not simply a general appraiser or market research. Similarly, assessing the value of a privately held company necessitates the expertise of investment bankers or business valuation specialists. Expert opinion is crucial in resolving inconsistencies between public data and the true financial position. For instance, a discrepancy between reported income and the value of publicly held assets could be addressed by an expert analysis that illuminates undisclosed assets or complex financial structures, thereby refining the estimate of net worth. Consequently, an accurate assessment relies not just on easily accessible public data, but also on insights provided by specialized experts.

Understanding the role of expert opinion is essential in accurate net worth calculations. The interplay of various expert opinions helps produce a more comprehensive and robust estimate. By including expertise from across different financial disciplines, a holistic picture emerges, reflecting the nuances of an individual's financial situation. This integration, however, also presents challenges. Disagreements among experts can arise, highlighting the inherent subjectivity in some estimations. The methodology used and the qualifications of the expert can affect the outcome. Further, the cost of expert consultation can influence the feasibility of conducting a detailed appraisal, thereby potentially limiting the scope of the valuation. These considerations underscore the importance of careful selection and appropriate application of expert opinions, fostering transparency and accountability in such estimations.

Frequently Asked Questions

This section addresses common inquiries regarding the estimation of Pedro Rivera's net worth. Precise figures are often elusive due to the private nature of financial matters. These responses aim to provide clarity on relevant aspects of such estimations.

Question 1: How is Pedro Rivera's net worth estimated?

Net worth estimations are typically based on publicly available information, such as property records, financial disclosures, and income reports. Experts, utilizing various valuation methods, consider reported income, assets (real estate, investments, etc.), and liabilities (debts). These methods combine publicly available data with expert analysis to arrive at an estimated net worth figure.

Question 2: Why is a precise figure for Pedro Rivera's net worth challenging to obtain?

Precise calculations are often complicated by the private nature of investments and financial holdings. Intricate financial structures, such as trusts or partnerships, can conceal ownership or control, making it difficult to determine the true extent of assets. Information about private investments and high-value assets is frequently unavailable to the public.

Question 3: What role do public records play in estimating net worth?

Public records, like property records and tax filings, serve as a starting point. While incomplete, these records offer data points about assets and income. However, they often do not fully reflect the total picture, especially regarding privately held assets and complex financial arrangements.

Question 4: How do investments influence the estimation of net worth?

Investment returns, both positive and negative, directly impact net worth. The types of investments held and their performance over time significantly influence the estimated overall financial position. Fluctuations in market values and diversification strategies are vital considerations.

Question 5: How do liabilities impact the overall net worth calculation?

Liabilities, such as debts and outstanding obligations, reduce the net worth figure. Accurate assessment of liabilities is essential to arrive at a comprehensive and balanced estimate of overall financial standing. Omitting or inaccurately calculating liabilities can distort the calculated net worth.

Question 6: What role do experts play in estimating net worth?

Experts in finance, accounting, and valuation provide insights, especially regarding complex assets or private holdings. Their expertise assists in accurately evaluating intangible assets and navigating the complexities of financial structures. However, expert opinions can vary, introducing a degree of subjectivity into estimations.

In summary, estimating net worth, especially for public figures, is a complex process requiring careful analysis of available information. Public records, expert opinions, and an understanding of both disclosed and undisclosed elements are essential factors in developing these estimations.

The following section will delve into specific aspects of Pedro Rivera's career and achievements, offering context for understanding the factors contributing to wealth estimations.

Tips for Evaluating Net Worth Estimations

Evaluating net worth estimations requires a nuanced approach. Directly determining a precise figure is frequently challenging, particularly for individuals with complex financial structures and significant private holdings. These tips offer guidance for analyzing such estimations.

Tip 1: Scrutinize Public Records. Begin by meticulously reviewing publicly available records. Property records, financial filings (if available), and tax information can provide valuable insights into assets, income, and potential liabilities. This initial step offers a starting point for further investigation.

Tip 2: Seek Expert Analysis. Consulting financial experts, such as accountants, financial analysts, or investment advisors, is crucial. Their specialized knowledge assists in interpreting complex financial structures, assessing the value of various assets, and factoring in potential liabilities not readily apparent from public records.

Tip 3: Understand Valuation Methods. Different valuation methods apply to different asset types. Real estate valuations typically utilize comparative market analysis, while investment portfolios require examining market prices and potential returns. Understanding the employed methodology is crucial for assessing the reliability of the estimated net worth.

Tip 4: Account for Potential Private Holdings. Public records often do not capture the full extent of an individual's assets. Private investments, holdings in trusts, or complex financial arrangements may significantly impact the overall net worth but remain undisclosed. Account for the possibility of substantial, undisclosed holdings.

Tip 5: Acknowledge the Limitations of Public Data. Publicly available information may not be comprehensive or entirely accurate. Data might be incomplete, outdated, or subject to misrepresentation. Recognize the limitations and consider that the public data may only offer a partial view of the overall financial picture.

Tip 6: Assess the Potential Impact of Economic Fluctuations. Economic conditions and market cycles influence asset values. Analyze how these economic factors might have affected the valuations used in arriving at the net worth estimation.

Tip 7: Analyze the Methodology. Thoroughly review the methodology used to arrive at the net worth estimation. Understand the specific valuation methods applied to different asset classes and evaluate whether the methodology is appropriate and comprehensive.

Tip 8: Compare Estimates. Comparing various estimates from different sources or experts adds a layer of scrutiny. Inconsistencies or significant differences between estimates could signal potential issues with the methodology or underlying data.

Following these tips can contribute to a more informed evaluation of net worth estimations, promoting a greater understanding of the process and its inherent complexities. Such informed scrutiny is critical, particularly in assessing the financial positions of prominent individuals.

This comprehensive approach highlights the complexities of evaluating net worth. A more complete picture requires careful consideration of the totality of available information and a recognition of the inherent limitations in assessing financial standing.

Conclusion

Determining the precise net worth of Pedro Rivera, as with many prominent figures, presents significant challenges. Publicly available data, while offering a foundation, frequently falls short of providing a comprehensive picture. The complexities arise from the inherent limitations of public records, the private nature of certain investments, and the use of potentially varied valuation methodologies. Analysis necessitates a careful consideration of assets, liabilities, income sources, and the impact of economic factors. Expert opinions, while valuable, can vary, further highlighting the inherent subjectivity in such estimations. Ultimately, a definitive figure remains elusive, underscoring the inherent difficulty in assessing the total financial position of individuals with substantial and often undisclosed holdings.

The exploration of this topic underscores the multifaceted nature of wealth assessment. It emphasizes the importance of critical evaluation, considering the limitations of available data, and acknowledging the inherent uncertainties. This process compels a nuanced understanding of economic factors, investment strategies, and the interplay between public and private information. Future analysis might benefit from further transparency in financial disclosures, enabling more comprehensive and reliable estimations of net worth in similar scenarios. Understanding these complexities is crucial for informed public discourse and accurate representation of financial realities.

Article Recommendations

- Henry Hopper

- Walterbrennan

- Will Shadley

- Adam Sandler Birthday

- Ebon Moss The Punisher

- Alessandro Nivola Movies

- Mean Joe Greene Born

- Celia Weston Movies And Tv Shows

- Fairy Tail 100 Year Quest Ep 2

- Ghoomer Movie